Content

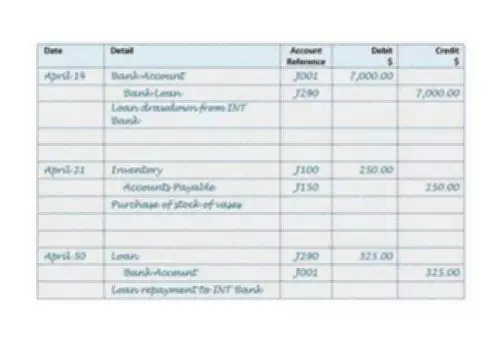

T-accounts also are useful when recording adjusting entries, which include accruals and deferrals made at the end of a period. Each type of account listed in a general ledger carries a normal balance of a debit or credit. After all transactions are entered into the appropriate T-accounts, the total amount of debits made to all of the T-accounts should equal the total amount of credits made to all of the T-accounts. If the total amount of debits and credits do not balance, you should recheck all of the transactions to verify that you entered the amounts correctly.

5 Ways Manual Accounting Processes Multiply Costs – Global Banking And Finance Review

5 Ways Manual Accounting Processes Multiply Costs.

Posted: Mon, 29 Aug 2022 14:38:32 GMT [source]

For instance, one of the most common accounts is the company checking account. Transactions such as paying bills decrease this account and making deposits increases the account. Assume an ending balance of $1,000 from last month in your company checking account. When you write a check for rent in the amount of $110, what is at account in accounting you subtract that from the balance. When you make a cash sale in the amount of $500 and deposit the cash into the bank, you increase the balance in your company records. Accounts Payable AccountAccounts payable is the amount due by a business to its suppliers or vendors for the purchase of products or services.

Account

Stock or securities for this purpose includes contracts or operations to acquire or sell stock or securities. It does not matter if the total 60 dayperiodbegins in onetax yearand ends in another. Instead, the basis in the newly acquired stock or securities is the same basis as of the stock or securities sold, adjusted by the difference in price of the stock or securities. These are a set of rules intended to be a single comprehensive set of rules to govern the capitalization, or inclusion inINVENTORYof direct andindirect costof producing, acquiring and holding property. Under the rules, taxpayers are required tocapitalizethe direct costs and an allocable portion of the indirect costs attributable to real and tangiblepersonal propertyproduced or acquired for resale.

How to Pick a Business Bank Account – Morningstar.ca

How to Pick a Business Bank Account.

Posted: Fri, 26 Aug 2022 10:04:19 GMT [source]

Enrol and complete the course for a free statement of participation or digital badge if available. Anyone can learn for free on OpenLearn, but signing-up will give you access to your personal learning profile and record of achievements that you earn while you study. An account may be classified as real, personal or as a nominal account. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.

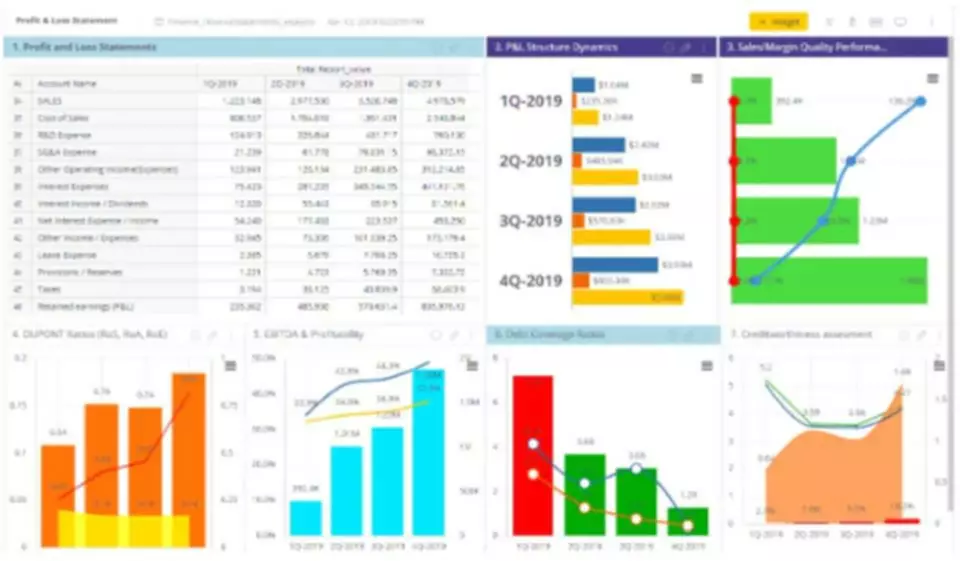

Consolidated Financial Statements

Confirm the auditor’s understanding of the process flow of transactions. Total number of stock shares, bonds, orCOMMODITIESfutures contracts traded in a particularperiod. Rate of spending, orturnoverof money- in other words, how many times a dollar is spent in a givenperiodof time. ConsumptionTAXlevied on theVALUEadded to a product at each stage of its manufacturing cycle as well as at the time of purchase by the ultimate consumer. Total costs that change in direct proportion to changes in productiveoutputor any other measure ofvolume.

- Each account in the ledger gets two entries, a debit and a credit, that must balance each other out.

- If you add up the totals of the debits and credits in all four T-accounts, you will see that they balance.

- ADEBTthat falls due more than one year in the future or beyond the normalOPERATING CYCLE, or that is to be paid out of noncurrent assets.

- Consider the word “double” in “double entry” standing for “debit” and “credit”.

ACCOUNTINGmethod of valuinginventoryunder which the costs of the last goods acquired are the first costs charged toexpense. This allows acreditfor 20 percent of qualified tuition and fees paid by the taxpayer with respect to one or more students for any year that the HOPE SHCOLARSHIP CREDIT is not claimed. DEBTS orOBLIGATIONSowed by one entity to another entity payable in money, goods, or services. Any book of accounts containing the summaries ofdebitandcreditentries. Conveyance ofland, buildings, equipment or other ASSETS from one person to another for a specificperiodof time for monetary or other consideration, usually in the form of rent. Any book containing original entries of daily financial transactions. If nointerestor an unrealistic amount of interest is charged in a salve involving certain kinds of deferred payments, then thetransactionwill be treated as if the realistic rate of interest had been used.

When teaching accounting or bookkeeping

On the left side of the T table, under the account name, that’s what we call the debit side . At its basis debit simply means left side; credit simply means right side. For example, a company’s checking account has a credit balance if the account is overdrawn. Debits (abbreviated Dr.) always go on the left side of the T, and credits (abbreviated Cr.) always go on the right.

The excess ofREVENUESover allvariable costsrelated to a particular salesvolume. Presentation of financialstatementdata without theACCOUNTANT’S assurance as to conformity with GENERALLY ACCEPTED ACCOUNTING PRINCIPLES . FINANCIALSTATEMENTpresentation in which the current amounts and the corresponding amounts for previous periods https://business-accounting.net/ or dates also are shown. Executive officer who is responsible for handling funds, signing CHECKS, keeping financial records, and financial planning for aCORPORATION. ACCOUNTANTwho has satisfied the education, experience, and examination requirements of his or her jurisdiction necessary to be certified as a public accountant.

Tax Busy Season Resource Guide

They are taxed on all of their INCOMEworldwide in the same manner a citizen of the United States is. EXPENDITURES for making good or whole the portions of property that have deteriorated through use or have been destroyed through accident. EXPENDITURES made in order to keep property in good condition but that do not appreciably prolong the life or increase thevalueof the property. Agency responsible for keeping track of the owners of bonds and the issuance of stock. Replacing an oldDEBTwith a new one, often in order to lower theINTERESTcosts of theissuer.