Contents

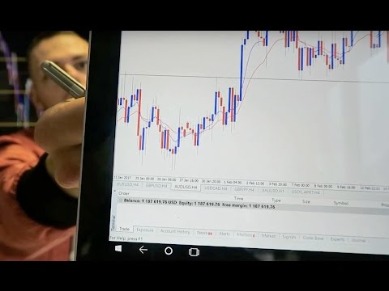

The graph you see below is a 4-hour candlestick chart where each of the candlesticks represents a 4-hour period. It’s quite simple actually, and it’s similar to the method for identifying charts on other graphed data. A candlestick pattern is a particular sequence of candlesticks on a candlestick chart, which is mainly used to identify trends. A candlestick chart (also called Japanese candlestick chart or K-line) is a style of financial chart used to describe price movements of a security, derivative, or currency.

However, the price has ultimately returned to the starting point. During a strong trend, the candlestick bodies are often significantly longer than the shadows. The stronger the trend, the faster the price pushes in the trend direction. During a strong upward trend, the candlesticks usually close near the high of the candlestick body and, thus, do not leave a candlestick shadow or have only a small shadow. Plots a candlestick chart from a series of opening, high, low, and closing prices of a security.

WikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each https://topforexnews.org/ is backed by trusted research and meets our high quality standards. Consult Benzinga’s guide to the market’s top brokers to get started today. “Trading is all about having an edge in the game and knowing the mathematical probability behind each trade”. By winning big and losing small, a single win can potentially cover 3 or more losses. If you apply this methodology in the long run, you will be a winning trader. Thus, seeing the Doji candle will often indicate an upcoming price reversal.

Before you enter a buy trade, make sure the inverted hammer candle is bullish. The bullish sentiment can be confirmed by other candle patterns, like engulfing, hammer, three white soldiers, and so on. A bullish candlestick is a full-body green or white candle with a wide range that can have short shadows. When a bullish candlestick appears, it means a sharp increase in the number of asset purchases, suggesting one could enter a long. The price direction is the price movement line indicated by the candle body. The candlestick colour shows whether the price falls or rises.

https://forex-trend.net/ candles are typically represented as red or black colors. Some traders find it easier to read bar charts; others prefer candles. The best approach is to open a demo account and try out trading using both – you’ll soon discover which works best for you. The very concept of candlestick charts used in forex trading comes from Japanese rice farmers in the 18th century. Candlesticks build patterns were introduced to the Western world by Steve Nison in his popular 1991 book, “Japanese Candlestick Charting Techniques.”

These markets include forex, commodities, indices, treasuries and the stock market. Stocks represent the largest number of traded financial instruments. The prices at which these instruments are traded are recorded and displayed graphically by candlestick charts. Candlestick charts are one of the most prevalent methods of price representation.

R2022b: Support for negative price data

This form of price representation was invented in Japan and made its first appearance in the 1700s. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Bullish patterns may form after a market downtrend, and signal a reversal of price movement. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. Before you start trading, it’s important to familiarise yourself with the basics of candlestick patterns and how they can inform your decisions.

The first https://en.forexbrokerslist.site/ signal is a shooting star candlestick, suggesting a soon reversal. Next, there is a bearish engulfing pattern, with a hanging man reversal pattern inside. You see from theBTCUSD daily chart below that, following a long consolidation in a sideways channel, the price has formed a key support level. A series of bullish hammer patterns appeared there, following which, the market reached a new price high. Based on how the candlesticks are located, you can anticipate the future price movement.

What is candlestick trading?

You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. This information has been prepared by IG, a trading name of IG Markets Limited. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

It consists of a bearish candle followed by a bullish candle that engulfs the first candle. This represents the power of a candlestick chart, that long wick was able to tell us so much about the mindset of the market in just a second. The highest point of the upper wick shows you the highest traded price for that time period. If the open or close was the highest price, then there will be no upper wick. Traders can alter these colors in their trading platform. For example, a down candle is often shaded red instead of black, and up candles are often shaded green instead of white.

What is Trident and How Risk-to-Earn Will Change Existing GameFi

They tell you where sentiment on a market might be headed, which you can use to predict where price will go next. When the market consolidates for a while, it is basically setting up to break out in one direction or the other. The formation of this bullish candlestick pattern was the signal as to which way the market was about to break. Candlestick charts are a useful tool to better understand the price action and order flow in the forex market. However, before you can read and explain a candlestick chart, you must understand what it is and become comfortable identifying and using candlesticks patterns. When you memorize the candlestick patterns, you also need to know what’s the rationale behind them.

- The difference between them is in the information conveyed by the box in between the max and min values.

- Besides, you can determine the high and the low of each candlestick.

- It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down.

- The trade is exited with a profit of $12.41 in eight hours.

- You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

A spike is a single candlestick pattern, with a small or no body and a long wick up or down. When a hammer forms at the high, following a long uptrend, it means the trend should soon turn down. The wick of the candlestick represents the price high and low over a particular period. When analysing a candlestick chart, it is also important to take into account the time intervals of emerging candles or the so-called timeframes. I was having tremendous trouble reading a price chart on how to determine its direction and what the candles were telling me and what it was saying as price reached my key levels!

It tells you that sellers are giving up, and buyers are taking over. The red and green candle in the picture above shows a bullish and bearish candlestick, respectively, where the price is opened in one direction and closed in the opposite direction. The wider body is the part of the candlestick, which is also the main part that shows the opening and closing price. The candlesticks are color-codedto illustrate the direction of the price action movements. A white candlestick represents rising prices, whereas a black candlestick shows that the price fell during the period.

You calmed my heart with this information..your knowledge is wonderful.. Please can you offer some guidance on keeping a position in regard to timeframe. I use the daily to identify support and resistance and then use the 4H chart to plan my entry. But what I seem to find is that I hardly ever hold a position more than 8 hours if I’m lucky. Am I letting my emotions get the better of me, or is my approach wrong. I want to be able to gain from the trends over a decent period of time.

They are used by traders to determine possible price movement based on past patterns, and who use the opening price, closing price, high and low of that time period. They are visually similar to box plots, though box plots show different information. This article will help you understand trader psychology and analyse candlestick patterns to trade in financial markets successfully. You can practise your technical analysis skills on the free demo account without registration withLiteFinance.

One popular technical indicator to follow such a strategy is the Fibonacci retracements tool, which plots lines at significant Fibonacci levels based on a recent move. When combined with candlestick patterns, this can be the basis for a powerful forex trading strategy. Candlestick patterns are useful for trading any market – but they’re particularly prized by forex traders, who often want to find trades quickly using technical analysis. All the patterns we cover above can be used to identify new forex opportunities, plus others such as the three white soldiers pattern, the morning star pattern and flags. Technical traders also use candlesticks to get quick insight into the general sentiment surrounding a market. They do this by watching for candlestick patterns – but we’ll cover those in more depth later.

There are also continuation patterns, signaling the ongoing trend to continue. The Balance uses only high-quality sources, including peer-reviewed studies, to support the facts within our articles. Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy. Your daily writings and articles has been so helpful to me in my journey as a trader. I was learning from ur pre videos…but after reading this ,i got clear all my doubts..

Since these forces on the price are roughly equal, it is very likely that the previous trend will end. This situation could bring about a market reversal, which is a price move contrary to the preceding trend. Candlestick charts have become the standard choice for technical traders today for a good reason.

Candlestick charts show us the price action that took place in the assets in detail. After a small amount of timely usage, candlestick chart pattern analysis can play an integral role in the day-to-day life of a trader. Learn Price Action Trading Strategies in detail in the Quantra course. Candlesticks are the graphical representations of price movements which are commonly formed by the open, high, low, and close prices of a financial instrument.